Ancillary information

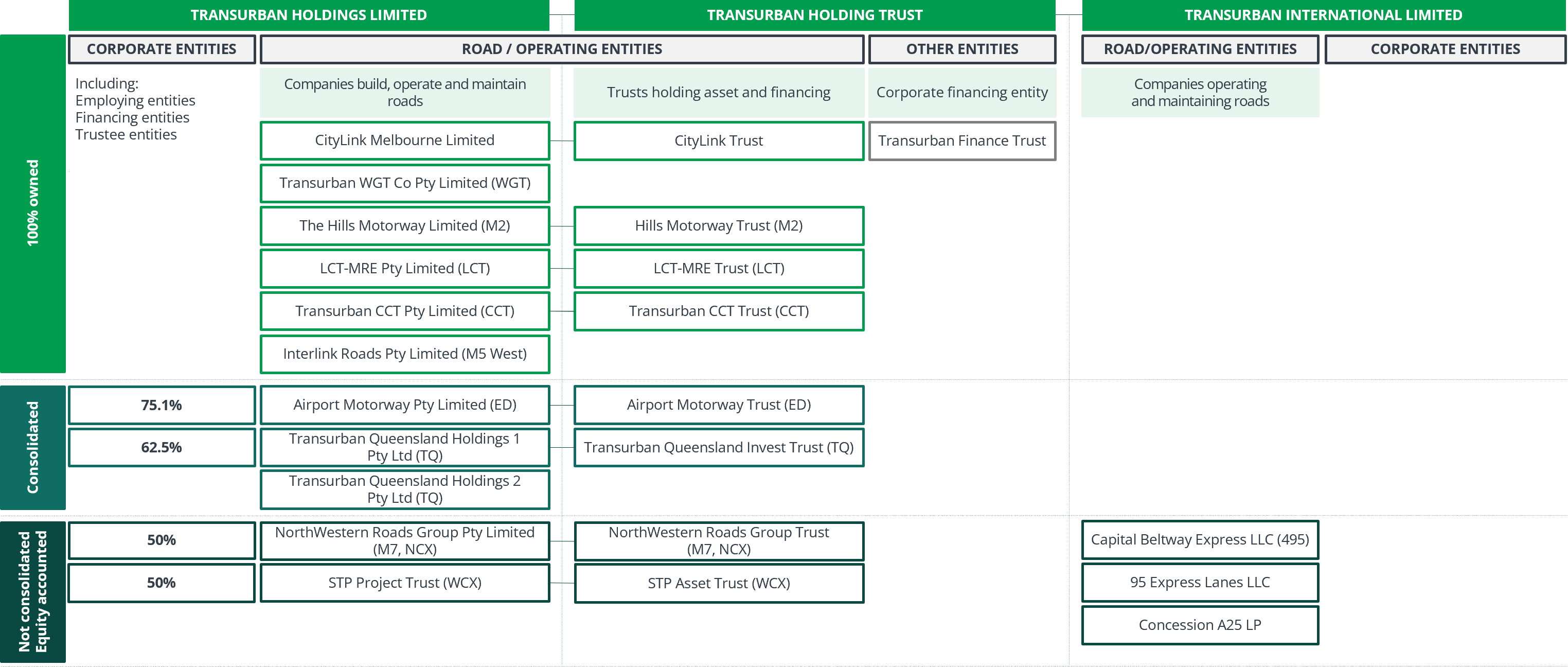

Group Structure

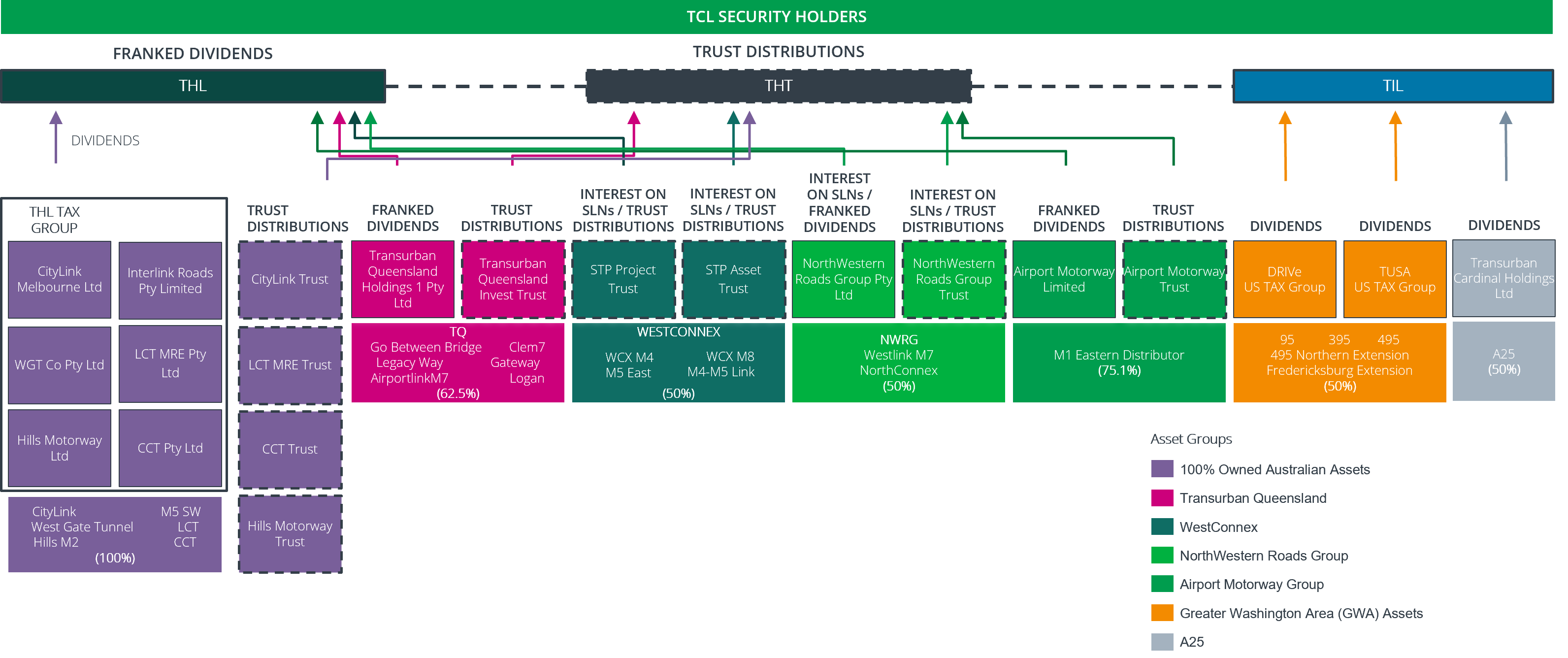

Tax Groups

Financial Risk Management

The Group's activities expose it to a variety of financial risks, including interest rate risks. Financial risk management is carried out centrally in accordance with Board approved policies, which are reviewed on an annual basis. The Board is regularly informed of material exposures to financial risks and how they are managed.

Operations are actively monitored to identify financial risks and manage them with hedging instruments where appropriate. Our policy is to hedge between 80% and 100% of interest rate exposures (defined as drawn debt) and ensure compliance with funding facility covenants. Derivative transactions are permitted for managing financial risk only and not speculative trading.